(Bloomberg) -- The Federal Reserve roiled U.S. markets on Wednesday, sending Treasury yields higher after predicting that it will cut interest rates next year and lower stock prices. It was the worst rate-day loss for the S&P 500 since 2001.

Most read by Bloomberg

The S&P 500 fell below 6,000, suffering its worst session since August. The tech-heavy Nasdaq 100 fell 3.6%, the most in five months. Markets fell after Micron Technology Inc reported earnings.

Subscribe to the Bloomberg Daybreak podcast on Apple, Spotify or wherever you listen.

The yield on the policy-sensitive two-year U.S. Treasury rose 10 basis points to 4.35%, the 10-year yield last seen in May. Bloomberg's U.S. dollar is at its highest level since November 2022.

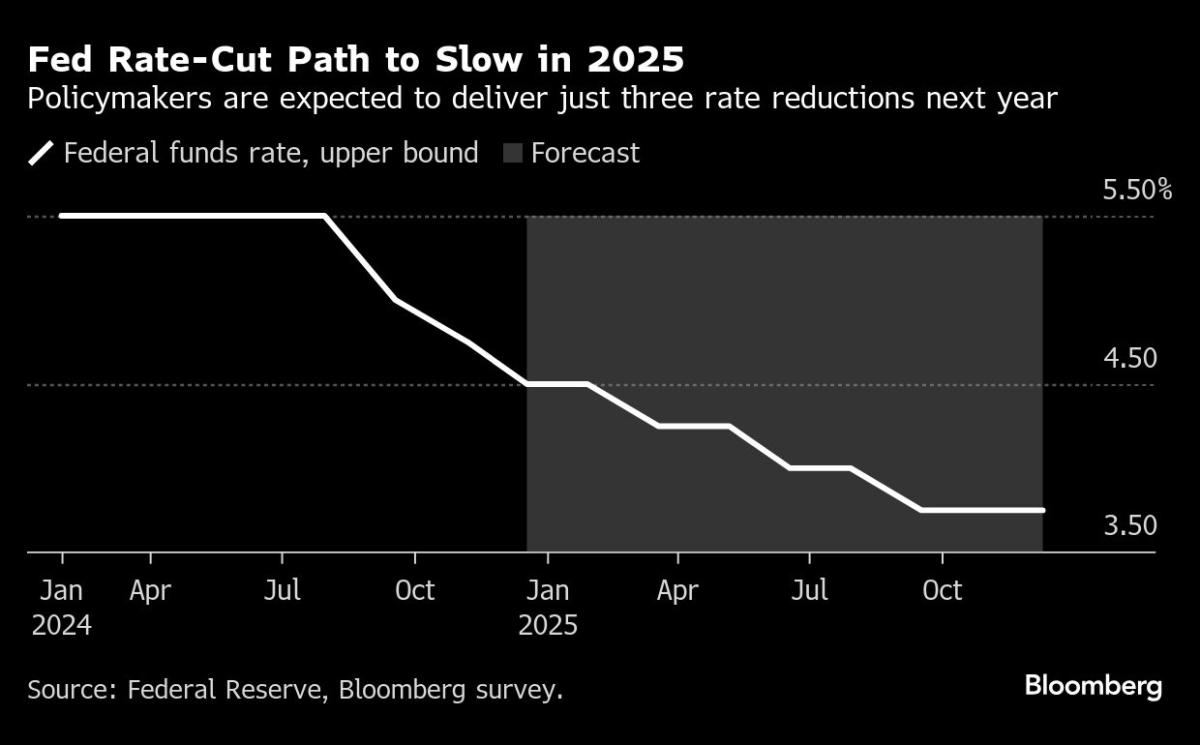

Jerome Powell cut interest rates by a quarter of a point widely expected after a meeting of the Federal Open Market Committee, but the central bank signaled rising inflationary concerns, including a weakening of its members' outlook for economic growth in 2025. The bank said it would be more cautious as it considers further changes to policy rates, and that the Fed is on track to reach its 2% target.

"We need to see inflation progress," Powell said. "That's how we think about it. It's kind of new. We've moved fast to get here, but progress is slow."

The pace of Wednesday's decline is consistent with the pace of the Fed's return to its anti-inflationary stance. Ahead of its most recent meeting, the S&P 500 has rallied more than 10 percent since the FOMC's July 31 interest rate decision, as the central bank shifted its risk assessment from one-sidedness and said expanding the labor market was a top priority.

At a press conference on Wednesday, the chairman also said some policymakers have begun to factor into their forecasts the impact of higher tariffs that President-elect Donald Trump might implement. But the impact of such policy proposals is still unclear, he said.

Max Gohman, senior vice president at Franklin Templeton Investment Solutions, called Powell "a hawk in pigeon's clothing."

"While bragging about a strong economy and recent reductions in inflation, tariffs are not considered temporary and policy must remain restrained, reminding us that two reductions are needed until 2025," he said. said.

The S&P 500's last big loss was on September 17, 2001, the day of the Fed's decision, when the index fell nearly 5%. It fell 12 percent on March 16, 2020, a day after the Federal Reserve's emergency weekend meeting amid the pandemic.

Source link