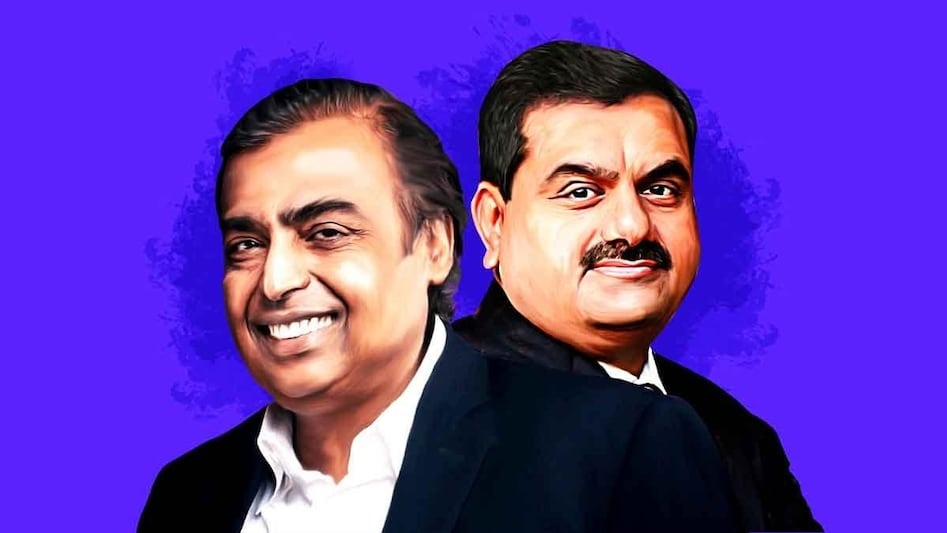

Mukesh Ambani, chairman of Reliance Industries, and Gautam Adani, founder of the Adani Group, have dropped out of the elite $100 billion club, according to the Bloomberg Billionaires Index. This is because Ambani and Adani have faced challenges affecting their businesses and personal wealth.

Ambani's energy and retail businesses have underperformed, and investors have also been concerned about debt. According to Bloomberg, Ambani's wealth stood at around $120.8 billion in July, when the Ambanis hosted the $600 million Anant Ambani-Radhika Merkata wedding.

According to the report, the country's richest man is focusing on a strategic shift to drive the conglomerate's growth in digital platforms, retail brands and renewable energy. But sales and profit growth have slowed in the retail business.

Meanwhile, Adani has been embroiled in regulatory issues. The empire was recently rocked by a US Department of Justice investigation that accused the company of alleged bribery. Gautam Adani, his nephew and chief executive Sagar Adani and AGEL managing director Vneet S Jaain have been accused of being part of a scheme to pay bribes to secure power supply contracts in India and defrauding US investors. This is the second major blow to the conglomerate, which has sought to shore up investor confidence, after Hindenburg Research accused the group of financial wrongdoing.

Adani, which hit a fortune of $122.3 billion in June, has denied all allegations and vowed to fight back. He strengthened his finances after the Hindenburg attack, but the US accusations affected him again.

Reliance shares fell 3.43 percent in 2024, against an 11.93 percent rise in the benchmark BSE Sensex, while Adani Group shares also came under heavy selling pressure following allegations by US authorities.

Source link