Unlock Editor Digest for free

Rawla Khalaf, editor of the FT, selects her favorite stories in this weekly newsletter.

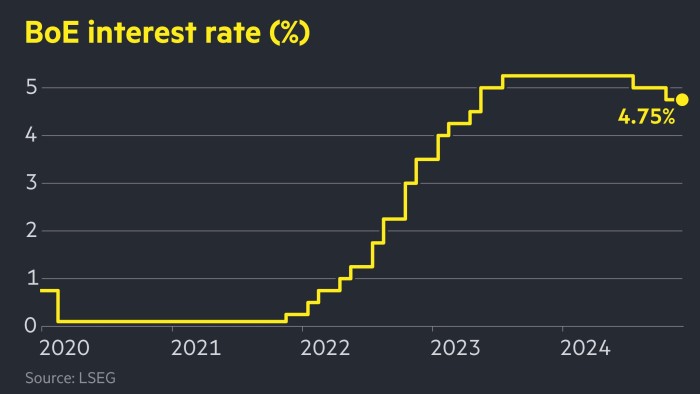

The Bank of England has kept interest rates on hold at 4.75 percent as it seeks to combat both stubborn inflation and weak growth.

In a six-to-three decision, most members of the Monetary Policy Committee warned that recent increases in wages and prices had "increased risks to inflationary stability", dampening expectations for a sharp rate cut in 2025. is

"We think a gradual approach to future interest rate cuts remains appropriate," said Andrew Bailey. boi Governor "But with the increased uncertainty in the economy, we cannot commit to when or how much we will cut rates in the coming year."

He added that the BoE needed to ensure it could meet the "2 percent inflation target on a sustained basis".

Rob Wood, UK economist at Pantheon Macroeconomics, said the minutes of the meeting were "careful and therefore smarter than the six-three headlines".

He added that inflation was likely to rise above 3 percent in the spring, "with highly visible price increases that could destabilize inflation expectations that are already above average and rising".

The BoE's relatively tough language came a day after the US Federal Reserve signaled that it Slow the pace of its rate cuts Next year amid signs of continued inflation.

The UK's central bank faces two consecutive months of falling GDP as well as rising price pressures, complicating its plans to cut interest rates next year.

Thursday's decision, which was in line with forecasts from economists polled by Reuters, came a day after data showed that Britain's inflation rate reached 2.6 percent Last month, from 2.3 percent in October.

But the three MPC members who supported a quarter-point cut — Deputy Governor Dave Ramsden, Alan Taylor and Swati Dhingra — cited "sluggish demand" and a weak labor market.

"Given the evolving balance of risks, a less restrictive policy rate was needed," they said.

BoE staff now expect zero growth in the final quarter of this year, weaker than forecast in November.

"Most indicators of UK near-term activity have declined," the central bank said on Friday.

It said risks to global growth and inflation "have materially increased" from geopolitical tensions and trade policy uncertainty - US President-elect Donald Trump's US A clear reference to plans to raise tariffs on imports.

Sterling and gilt yields eased slightly after the widely expected decision to keep rates on hold. The pound fell to $1.261 after the BoE announcement, though it was still up 0.3 percent on the day.

The yield on rate-sensitive two-year government bonds edged lower to 4.46 percent.

In recent weeks, however, yields on government debt have risen, as investors grew nervous about inflation data and the Labor government's budget plans for additional borrowing.

Traders still expect the BoE to make two quarter-point cuts next year - the same as immediately before Thursday's decision. This compares with the recently expected four market in October.

"The vote was more unprecedented than the market had expected, suggesting it has moved too far recently to cut rates for next year," said Lee Hardman, senior currency analyst at MUFG.

The BoE cut rates by a quarter of a point at its last meeting in November, but signaled at the time that another cut was unlikely until 2025. It has already cut rates twice in 2024 and is due to announce its next rate decision on February 6.