Unlock Editor Digest for free

Rawla Khalaf, editor of the FT, selects her favorite stories in this weekly newsletter.

Rival classes of Thames Water bondholders took aim at each other in a London High Court hearing, in which Troubled convenience laid out its case for an emergency loan of up to £3bn from its top-ranking lenders.

The junior bondholders claimed in written documents submitted to Tuesday's hearing that the company's more senior creditors were "holding [Thames Water] bailed out by the strict terms of their "expensive" debt, which they argued was having "a chilling effect" on utility parallelism. Tries to increase equity From new investors.

The court hearing, which Thames Water said was "urgent", is the first step for the UK's biggest water and sewage company to get court approval to borrow up to £3bn from its top-rated "Class A" bondholders. is Without it, the company, which has a debt pile of around £19bn, would "run out of available liquidity on 24 March 2025", according to court documents.

The loan is part of the utility's attempt to temporarily avoid renationalization under the government's special administration regime. Thames Water serves 16 million people in and around London.

The loan proposal has a Fast sharp fatigue between the company and its lower-rated bondholders, who claim the utility has not properly considered their counteroffer for an equivalent £3bn loan at a cheaper price and more favorable terms.

This is what the so-called Class B bondholders are now looking for Challenge action and launched its own parallel restructuring plan, which lawyers say will be the first time a judge has been asked to consider rival proposals since Thames Water uses a new restructuring system due to come into effect in 2020.

Thames Water's barrister told the court on Tuesday that the proposed loan "is not in itself a comprehensive solution to Thames Water's financial difficulties". Instead, Thames Water is borrowing money to shore up its liquidity until the regulator, Ofwat, determines how much it and other water companies can raise customer bills. This decision has been fixed on Thursday.

For their part, senior bondholders described their opposition group's proposal as an "unnecessary diversion to further their interests."

A barrister representing the Class A debtors told the court that arguments that their debt would have a chilling effect on Thames Water's planned parallel equity raising "seem unlikely", while it was argued that the junior bondholders in the proceedings were trying to "extract the time-line". Hoping to "improve their situation".

As well as drawing the ire of junior bondholders, the Class A loan proposal has also drawn criticism from campaigners, academics and experts, who have slammed the loan's high 9.75 interest rate and other costs that could cost the utility. As much as £800mn Over 2.5 years.

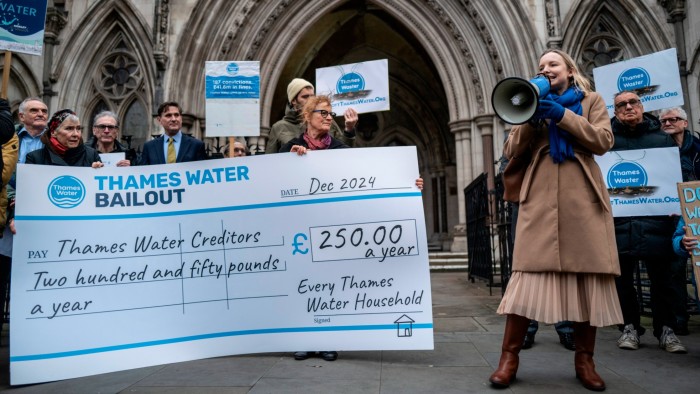

A group of campaigners staged a protest outside the Royal Courts of Justice on Tuesday, calling on Environment Secretary Steve Reid to "stop the High Court signing off on the Thames Water bailout".

Oxfordshire-based charity Windrush Against Sewage Pollution also wrote a letter to the court last week asking for evidence to be considered on behalf of Thames Water's bill payers, which the group argued was "pending Creditors” have “no say” in the proceedings.

A judge can approve a reorganization plan if it has the approval of at least 75 percent of each class of creditors — but failing that, will consider a plan that would make any of the company's creditors a so-called " Does not leave the worse under "relevant option".

The company has argued that the appropriate alternative to their debt is special administration, with expert analysis showing that a future restructuring of Thames Water's debt would result in a total wipe-out for Class B bondholders, compared to a token 3.5 per cent recovery.

However, there is still "insufficient clarity" about what a special administration would look like, Class B bondholders claim.

A 131-page analysis of Thames Water, prepared by consultants Teneo, shows how disastrous a special administration could be for all bondholders, presenting what it would have been like if Thames Water had fallen into administration without a favorable Ofwat. If so, the senior group can get less than half of their money back. The deal on the bill goes up.