Tyme Group, a South African-born fintech operating in the African country and the Philippines, raised $250 million in its Series D round, increasing its valuation to $1.5 billion. The financing was led by Nubank, the world's largest neobank, which invested $150 million for a 10% stake. The M&G Catalyst Fund contributed $50 million, while existing shareholders provided the remaining $50 million.

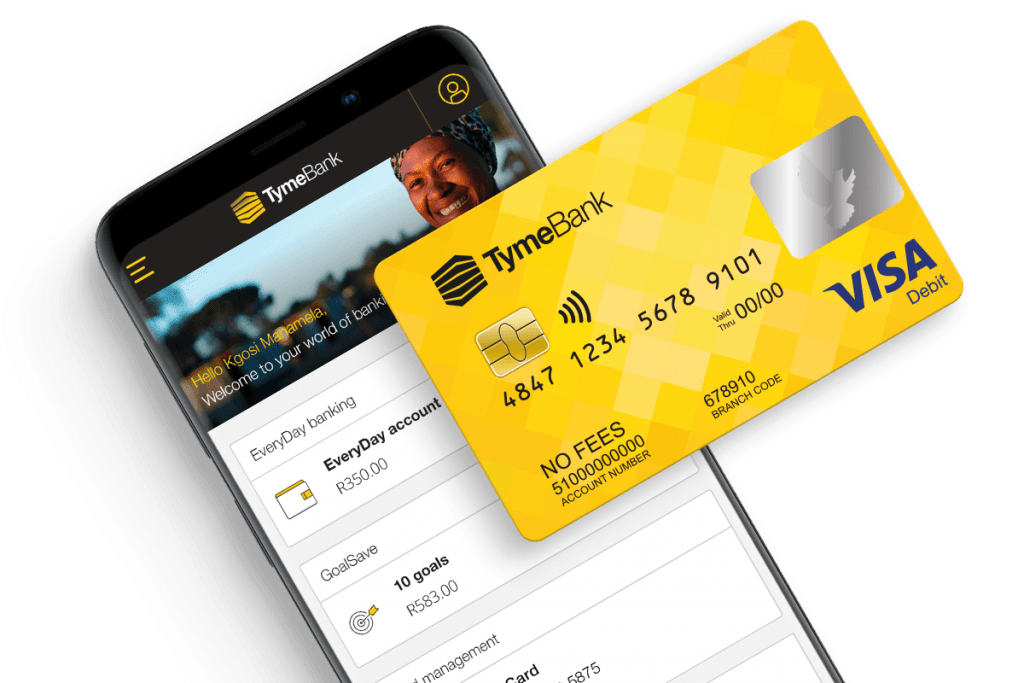

Founded in 2019, Singapore-based Tyme Group operates a hybrid digital banking model that combines online banking with physical service touchpoints. The company, which currently serves 15 million customers, focuses on building and scaling digital banks in emerging markets. South African brand TymeBank has been a key driver of growth, while GoTyme in the Philippines, launched in 2022 in partnership with local conglomerate Gokongwei Group, marked its entry into Asia. The company plans to expand into Vietnam next year.

Tyme remains majority-owned by Patrice Motsepe's African Rainbow Capital (ARC), which owns a 40% stake in the fintech. Last year, the fintech raised $77.8 million in a pre-Series C round backed by Tencent, Blue Earth Capital and Norrsken22.

The latest funding underscores the recovery in investor appetite for fintech following a slowdown triggered by rising global interest rates. Tyme joins Nigeria's Moniepoint as African fintechs to achieve unicorn status this year.

Source link