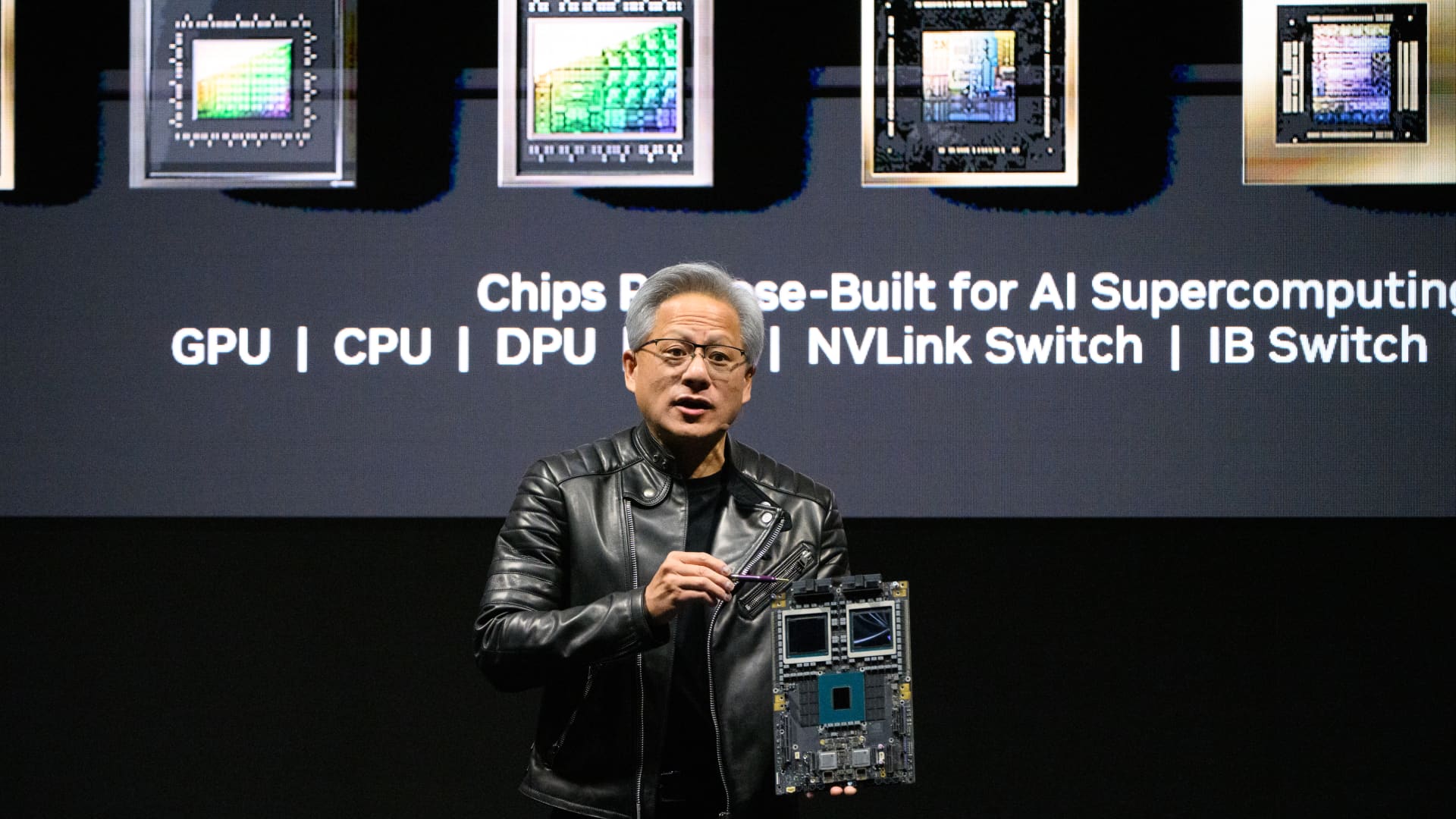

Jacques Silva Nurphoto Getty Images

Nvidia Shares fell on Monday, putting the beloved AI chip officially in correction territory even as the rest of the Nasdaq Composite rose to a record.

De facto chip and artificial intelligence trading is up 166% this year amid continued excitement for the buzzy tech trend. However, shares have faced a sluggish run of late.

The stock fell 4.5% in December and is officially in correction territory, sitting about 11% from its closing high of $148.88 reached last month. The definition of what constitutes a market correction can vary. Most generally consider it a 10% or more reduction from an all-time close.

The stock closed down 1.7%.

"You need Nvidia, and you need their chips for infrastructure," said Keith Lerner, co-chief investment officer at Truist. "But I think what the market is also saying is that there are other beneficiaries beyond that. There is rotation within the Magnificent Seven, which we have already seen a few times this year."

Nvidia shares on Monday

The recent underperformance at Nvidia may indicate some profit-taking on Wall Street after another marquee year. The maker of graphics processing units that support large language models benefited, as data center demand swelled from the launch of ChatGPT in late 2022.

But there are some reasons for concern for the market leader and fundamental player among the three major averages. The market continued to push to new highs as Nvidia underperformed. This can be a warning sign if the pattern continues, with Roth MKM notes that the level of $125 to $130 marks a key test for the stock and the general market.

As Nvidia struggles, other chip stocks have fared well, with Broadcom Monday which gives power to new highs. The stock rose about 11% during Monday's session, builds on a 24% rally. from Friday that pushed the stock above a market capitalization of $1 trillion after a strong earnings report.

The Nasdaq Composite hit a record trading Monday without Nvidia's help.

"Broadcom's comments last week probably prompted momentum investors to start looking there for even faster growth," said Kim Forrest, chief investment officer of Bokeh Capital Partners. "Momentum has been driving this stock. I don't think momentum is going to kill it quite yet, but momentum does what momentum does, which is looking for the higher flyer."

Other semiconductor stocks also rose on Monday, with Micron Technology up about 6% ahead of its quarterly results this week. Marvell Technology and Lam Research gained 3% and 2%, respectively, while On Semiconductors and Taiwan Semiconductor added about 1% each.